After a major storm, many roofs begin to give out, with leaks and drafts slowly but surely becoming commonplace nuisances for your family. In this situation, you’ll likely want a roof repair done as quickly, efficiently, and cheaply as possible – at least, assuming you don’t enjoy being woken up in the middle of the night by rainwater dripping on your face.

But, there’s a problem – roof repairs can be expensive, especially when the damage is severe. Fortunately, however, you might not have to cover the cost of these repairs; if you have homeowners insurance, you can file a claim with your insurance agency, provided that the damage was caused by a natural disaster, falling debris, or vandalism (for a detailed look at the types of roof damage covered by insurance, check out our article on the topic). In this article, we’ll offer a step-by-step guide on the roof damage insurance claim process, all so you can have peace of mind that you won’t have to spend thousands of dollars on just a few repairs.

1. Assess the Damage

In order to file an insurance claim, you first have to know the type and extent of the damage you’re dealing with. Of course, the best way to handle this is to hire a roofing contractor to do a roof inspection. After all, as experts in the field, we’re best equipped to identify any problems with your roof. However, since most roofing companies charge a few hundred dollars for an inspection, we understand why you’d want to evaluate the damage yourself. With that in mind, here are a few signs that your roof is damaged in a way that would justify an insurance claim:

- Torn window screens

- Nicks or gashes in your siding

- Dark or faded spots on your shingles

- Fallen debris, especially any that has landed on your roof

- Dents on your gutters or HVAC equipment (these are likely caused by impact damage from wind or hail)

- Cracked roof tiles

- And most importantly, leaks in your home

If you find any of these red flags after a storm, you may be entitled to an insurance payout.

2. Review Your Insurance Policy

Note that many insurance companies can be picky about which types of roofing damage they cover. For instance, most insurance policies don’t cover damage caused by animals, mold, or even earthquakes and flooding. Some also refuse to cover tornado and hurricane damage, especially in areas prone to these events. Because of that, always review your insurance policy to ensure that your roof damage is covered – you don’t want to go through the entire filing process only to have your claim denied!

3. Speak with a Roofing Contractor

Of course, you can’t avoid speaking with a roofing contractor forever. When you file your insurance claim, you’ll likely need an estimate of how much your repairs or replacement will cost, something that only a contractor can reliably provide. Fortunately, many contractors (including us!) offerfree estimates, so this process certainly won’t break the bank. Plus, qualified contractors speak the same language as insurance companies, documenting damage using all the technical jargon that your agency will want to see. As a consequence, a good contractor is a must-have at this stage of the filing process.

Note that when getting your estimate, your best bet is to obtain only one – if you get multiple, your insurance agency will want to see all of them. They’ll likely choose the cheapest option among these, resulting in lower-quality repairs than you could otherwise have.

4. Contact Your Insurance Company

Now, it’s time to actually file your insurance claim. You’ll call your insurance agency and notify them of the damage to your roof, sharing when and how it occurred. If possible, you should also send over photos and videos of the damage as extra documentation. Furthermore, this may be the point when your insurance company will want an estimate of repair costs, so providing them with the quote you previously obtained from your contractor is a good idea.

5. Prepare for Insurance Adjuster Visit

At this point, you’ll work with your insurance company to schedule a time for an insurance adjuster to evaluate and document the damage, helping the agency decide whether to accept your claim and, if they do so, how much your payout should be. Many roofing contractors are happy to assist their customers in the adjustment process, sending out an expert to provide the adjuster with any documentation and cost information they need during this process.

Since the adjuster’s findings will determine whether your claim is accepted or denied, their visit can be a nerve-wracking occasion. However, there’s no reason to worry – as long as the documentation you provided is in line with what they find, and the damage to your roof is covered by your insurance policy, you’re likely to get a payout!

6. Make Payments

If your claim is approved, all that’s left for you to do is make your payments! After you reach your deductible, your insurance company will send you a check (or in some instances, a series of checks). This is your payout, and you’ll forward it directly to the roofing contractor completing your repairs. Now, you can sit back and relax while your work is completed, and your roof will be as good as new in no time!

The roof insurance claim process can seem daunting at first, but in the end, it’s not as complicated as you might think. Now that you know how to navigate the process, you’re on the path to a better roof!

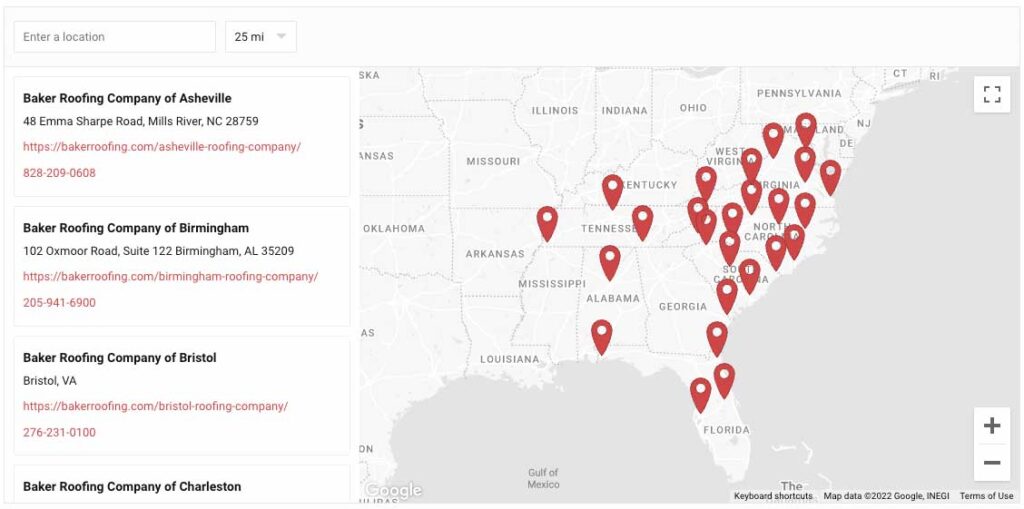

Looking for a reliable roofing company near you? For 109 years, Home Exteriors by Baker has been turning houses into homes through top-notch exterior renovations and unparalleled service that meets your unique needs. Let our family take care of yours – request a quote today!