Will Insurance Cover My Roof? Damage, Deductibles, and Savings

Time to read: 7 minutes

What Types of Roof Damage Are Covered by Homeowners Insurance?

Will Insurance Cover the Full Cost of Roof Repairs?

Will I Have to Pay a Deductible for Roof Damage?

Will the Repairs Affect How Much I Pay for Insurance?

Given that most roofs grow weaker as they age (often allowing them to sustain enough damage to require replacement in the first place), most insurance companies love to see their customers install new, sturdier roofs. Because these replacements will likely keep the companies from paying for even more costly repairs down the road, they often offer discounts to customers with roofs under ten years in age. This is especially true if those customers have shelled over a little extra money for upgrades to their roofs, allowing them to stand the test of time more than ever before – music to insurance companies’ ears. As such, roof replacements can often drop your homeowners insurance payments from anywhere between 5% and 35%, making replacing your damaged roof both a necessity and a worthy investment.

Conclusion

But like we said before, all of this information varies heavily between insurance companies, and the best way to make sure you’re secure is to review your policy. Nevertheless, a solid knowledge of how homeowner’s insurance relates to roof repairs and replacement will allow to you navigate the complexities of getting compensation for roof damage, giving you the peace of mind you deserve in the face of the unexpected.

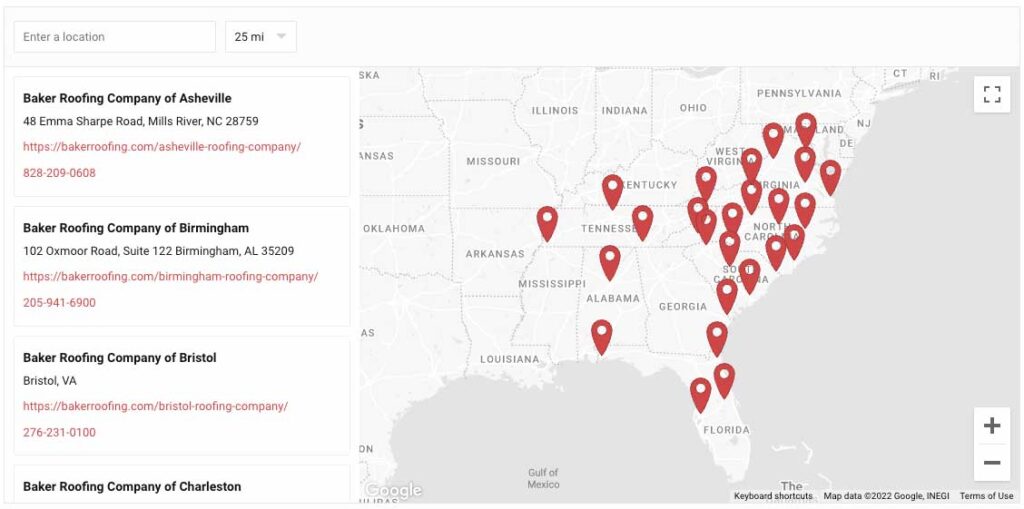

Still have questions? Baker Home Exteriors is the trusted name in roofing and home repairs all throughout the Southeast. Please don’t hesitate to contact our team to talk through your options and ensure you’re getting the roof you deserve.